Aktualnie online

· Gości online: 2· Użytkowników online: 0

· Łącznie użytkowników: 766,815

· Najnowszy użytkownik: urunovoqexe

Logowanie

Shoutbox

Musisz zalogować się, aby móc dodać wiadomość.

02/02/2026 11:59

Desire gorgeous girl?

Go ahead and test our reliable beauties!

Get Them Right Now!

02/02/2026 11:58

Want gorgeous lady?

Go ahead and experience our selected trusted women!

Get Them Right Now!

02/02/2026 11:58

Want stunning female?

Go ahead and try our own trusted beauties!

Get Them Right Now!

02/02/2026 11:58

Craving gorgeous female?

Just experience our trusted proven beauties!

Get Them Right Now!

02/02/2026 11:09

Hello. And Bye.

02/02/2026 05:08

you could try these out https://jaxxwallet

-web.org/

-web.org/

02/02/2026 04:41

like this https://jaxxwallet

-web.org

-web.org

02/02/2026 03:01

click for info https://jaxxwallet

-web.org/

-web.org/

02/02/2026 02:43

More Info https://jaxxwallet

-web.org/

-web.org/

02/02/2026 02:24

check this link right here now https://jaxxwallet

-web.org

-web.org

Zobacz temat

www.dyduch.eu :: O nas :: Nasze projekty

|

Free Advice For Picking Crypto Trading

|

|

| FrankJScott |

Dodany dnia 31-01-2023 19:17

|

|

Użytkownik Postów: 22 Data rejestracji: 21.12.22 |

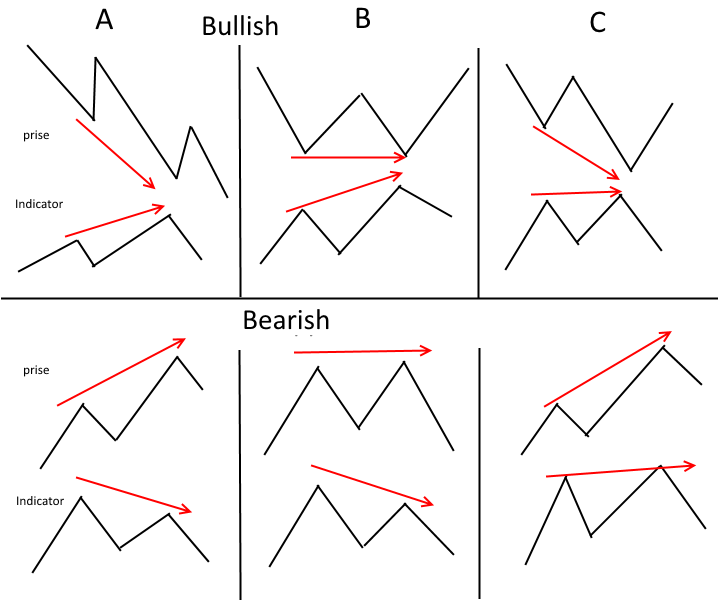

What Are The Main Factors That Determine Rsi Divergence Definition: RSI Divergence refers to an instrument for analysis of technical aspects that compares an asset's price fluctuations with its relative strength index (RSI). There are two kinds: regular divergence and hidden divergence. Signal: Positive RSI divergence indicates an upward signal. Negative RSI divergence is an alarm for bears. Trend Reversal : RSI divergence may indicate an upcoming trend reversal. Confirmation - RSI divergence must always be utilized in conjunction with other analysis techniques. Timeframe: RSI divergence is possible to be viewed over different timeframes in order to gain various insights. Overbought/Oversold RSI value of 70 or more indicates overbought conditions. Values less than 30 mean that the market is undersold. Interpretation: To interpret RSI divergence correctly it is necessary to look at other fundamental and technical factors. See the most popular automated trading software for more advice including best crypto trading platform, automated trading software, backtesting platform, forex backtest software, RSI divergence cheat sheet, backtesting strategies, forex tester, forex trading, backtesting, backtesting tool and more.  What Is The Difference Between Regular Divergence And Hidden Divergence? Regular Divergence occurs when an asset's value makes an upper or lower low while its RSI makes a lower or higher low. This can be a sign of a trend reversal but it is crucial to consider other fundamental and technical factors. Hidden Divergence occurs when an asset's price is lower highs or lower lows, when the RSI is able to make an upper or lower low. This indicates that a trend reverse could be possible even though it's more fragile than normal divergence. Technical factors to be considered: Trend lines and support/resistance indexes Volume levels Moving averages Other indicators and oscillators It is crucial to keep in mind the followingpoints: Economic data released Information specific to your company Sentiment indicators and market sentiment Global events and their impact on the market It is essential to take into consideration both technical and fundamental factors before investing in RSI divergence signals. View the best forex backtesting software for more examples including position sizing calculator, forex backtesting, cryptocurrency trading bot, forex backtesting, forex backtest software, crypto trading backtesting, best crypto trading platform, automated trading software, backtesting tool, position sizing calculator and more. [img]https://c.mql5.com/6/412/1__2.png' alt='miro.medium.com/max/1200/0*XMtWJZOfSqe2k94m[/img] What Are Back-Testing Trading Strategies To Trade Crypto Backtesting strategies to trade cryptocurrency involves simulating trading strategies on previous data to evaluate their likelihood of success. The following are some steps in backtesting crypto trading strategies:Historical Data: Obtain a historical data set for the crypto asset being traded, including prices, volume, and other relevant market data. Trading Strategy: Explain the trading strategy that is being tested. This is inclusive of rules for entry and exit as well as the size of your position. Simulator: This software simulates the execution of a trading strategy using historical data. This allows you to see how your strategy performed in the future. Metrics. Use metrics such as profitability and Sharpe ratio to evaluate the effectiveness of your strategy. Optimization: To optimize the strategy's performance, tweak the parameters of the strategy and perform a second simulation. Validation: Test the method using unpublished data to confirm its reliability and prevent overfitting. It is important to be aware that past performance is not indicative of future results Results from backtesting should not be relied upon as an assurance of future earnings. It is also essential to think about the effect of the volatility of markets along with transaction costs and other aspects of the real world when using the strategy for live trading. Read the best best trading platform for blog recommendations including trading platform cryptocurrency, trading with divergence, cryptocurrency trading bot, best crypto trading platform, crypto trading, backtesting strategies, forex backtesting software, cryptocurrency trading, trading divergences, automated trading bot and more. [img]https://c.mql5.com/6/412/1__2.png' style='border:0px' class='forum-img' /> What Can You Do To Assess The Forex Backtesting Software When Trading With Divergence When considering a forex backtesting program to trade using RSI divergence, these aspects should be taken into consideration: Data Accuracy Make sure the program has access to high-quality, accurate historical data for the currencies being traded. Flexibility: The software must allow customization and testing of different RSI divergence strategies. Metrics : The software should include a wide range of metrics to evaluate the performance RSI Divergence Trading Strategies, such as the profitability, risk/reward and drawdown. Speed: Software needs to be fast and efficient, which will allow you to quickly backtest multiple strategies. User-Friendliness. The software should be easy to understand even for those not having a technical background. Cost: You need to be aware of the cost of the program to determine if it's within your financial budget. Support: You must have excellent customer service. This includes tutorials and technical support. Integration: The program should integrate well with other trading tools including trading platforms, charting software and charting software. It's essential to test the software using an account on a demo before you commit to a monthly subscription to make sure it is compatible with your specific needs and that you are comfortable using it. View the most popular forex backtesting software free for more examples including crypto backtesting, forex backtesting software free, cryptocurrency trading, automated trading software, backtesting tool, backtesting platform, stop loss, crypto trading bot, backtesting, trading with divergence and more.  How Can Automated Trading Software Function With Cryptocurrency Trading Bots? The bots for trading cryptocurrency work within automated trading software that follows an established set of rules and executing trades on behalf of the user. This is how it works: Trading strategy: The user decides a trading plan, which includes entry and exit criteria and position sizing as well as risk management and risk control. Integration Through APIs the trading bot could be connected to cryptocurrency exchanges. This allows it to gain access to real-time market data and to execute trades. Algorithm : The bot utilizes algorithms for market analysis and make trading decisions based on the defined strategy. Execution Automated execution trades based on the rules laid out in the trading strategy without the need for manual intervention. Monitoring The trading bot continuously is monitoring and adapting to market conditions when needed. Have a look at the recommended best trading platform for more advice including crypto backtesting, position sizing calculator, automated trading platform, forex backtesting software, forex backtesting software free, bot for crypto trading, best forex trading platform, trading platform, crypto backtesting, trading platform crypto and more. A robot that trades in cryptocurrency could assist you in executing complex or repetitive strategies. Automated trading has its risks. There is the possibility of security flaws and software glitches. Additionally, you run the possibility of losing control of the trading decisions you make. It is vital to test and evaluate any trading robot prior to when it is used for trading live. Edytowane przez FrankJScott dnia 02-02-2023 10:34 Google it |

| Przeskocz do forum: |